All Categories

Featured

You will certainly now require to search for the "unsettled tax obligation" line for the prior tax obligation year to identify the total up to sub-tax. A redemption declaration is an additional resource made use of to identify sub-tax acquisition amounts. That quantity, plus the $5.00 charge, is the overall amount required to sub-tax. Personal and company checks are accepted.

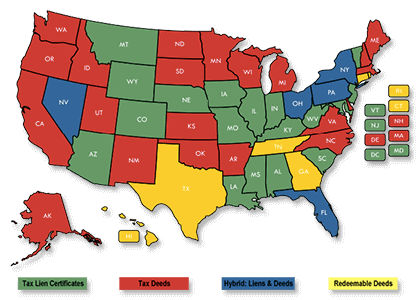

Genuine estate can be a rewarding investment, but not everybody wants to deal with the hassles that often feature owning and keeping rental residential or commercial property (tax lien investing texas). One method to purchase realty without being a property manager is to purchase building tax obligation liens. Every year, house owners in the united state fall short to pay about $14 billion in real estate tax, according to the National Tax Obligation Lien Association

Tax Liens Investing

When a homeowner falls back in paying real estate tax, the county or district may put tax obligation lien against the residential or commercial property. This guarantees that the residential or commercial property can't be refinanced or marketed until the tax obligations are paid. Instead of waiting for settlement of taxes, governments in some cases decide to offer tax lien certificates to private financiers.

As the proprietor of a tax lien certificate, you will obtain the interest payments and late fees paid by the house owner. If the property owner does not pay the taxes and charges due, you have the lawful right to confiscate on and take title of the property within a particular period of time (usually 2 years). Your revenue from a tax obligation lien financial investment will certainly come from one of 2 resources: Either interest repayments and late charges paid by house owners, or repossession on the property often for as little as pennies on the dollar.

The rate of interest paid on tax liens differs by state, however it can be as high as 36 percent each year. An additional advantage is that tax obligation lien certificates can in some cases be bought for as low as a couple of hundred dollars, so there's a low barrier to entry. Consequently, you can diversify your portfolio and expanded your danger by purchasing a number of different tax obligation lien certificates in various actual estate markets.

For instance, if the property owner pays the interest and fines early, this will certainly lessen your return on the financial investment (invest in tax lien certificates). And if the house owner proclaims insolvency, the tax lien certification will certainly be subordinate to the home mortgage and government back tax obligations that are due, if any kind of. Another threat is that the value of the home might be much less than the quantity of back tax obligations owed, in which case the homeowner will certainly have little reward to pay them

Tax lien certificates are usually sold by means of public auctions (either online or face to face) performed yearly by county or community straining authorities (tax lien vs tax deed investing). Readily available tax obligation liens are typically released numerous weeks before the public auction, in addition to minimal quote amounts. Inspect the internet sites of counties where you have an interest in buying tax obligation liens or call the area recorder's workplace for a checklist of tax obligation lien certificates to be auctioned

Investing Tax Lien

A lot of tax obligation liens have an expiration day after which time your lienholder civil liberties expire, so you'll require to move rapidly to enhance your chances of optimizing your investment return (how to invest in real estate tax liens). how to invest in tax liens. Tax obligation lien investing can be a lucrative way to purchase property, however success calls for extensive research and due persistance

Firstrust has greater than a decade of experience in supplying financing for tax lien investing, together with a devoted team of licensed tax lien professionals that can assist you leverage potential tax lien investing opportunities. Please call us to discover more concerning tax lien investing. FEET - 643 - 20230118.

Latest Posts

Investing In Secured Tax Lien Certificates

Tax Lien Investing 101

Arizona Tax Lien Investing