All Categories

Featured

Table of Contents

Selecting to purchase the actual estate market, stocks, or other typical sorts of assets is prudent. When making a decision whether you need to purchase recognized investor chances, you must balance the compromise you make between higher-reward potential with the lack of reporting requirements or regulative transparency. It has to be said that private placements require higher levels of danger and can frequently stand for illiquid investments.

Specifically, absolutely nothing here needs to be translated to state or suggest that past outcomes are a sign of future performance neither need to it be translated that FINRA, the SEC or any type of various other safety and securities regulator authorizes of any one of these safety and securities. Furthermore, when examining exclusive placements from enrollers or firms supplying them to recognized investors, they can provide no guarantees revealed or suggested as to precision, efficiency, or results gotten from any details supplied in their discussions or discussions.

The business ought to supply information to you with a document called the Exclusive Placement Memorandum (PPM) that offers a much more comprehensive description of expenses and threats connected with joining the investment. Passions in these bargains are only used to individuals who certify as Accredited Investors under the Securities Act, and a as specified in Section 2(a)( 51 )(A) under the Business Act or an eligible worker of the monitoring business.

There will certainly not be any type of public market for the Rate of interests.

Back in the 1990s and early 2000s, hedge funds were recognized for their market-beating efficiencies. Some have actually underperformed, specifically throughout the financial situation of 2007-2008. This alternate investing technique has a distinct method of operating. Usually, the supervisor of a mutual fund will certainly allot a part of their offered possessions for a hedged wager.

Where can I find affordable Real Estate For Accredited Investors opportunities?

For example, a fund supervisor for an intermittent field might commit a portion of the properties to supplies in a non-cyclical field to counter the losses in instance the economic climate tanks. Some hedge fund supervisors make use of riskier strategies like using borrowed money to purchase more of a property just to multiply their possible returns.

Comparable to shared funds, hedge funds are professionally managed by career investors. Nevertheless, unlike mutual funds, hedge funds are not as strictly controlled by the SEC. This is why they go through much less examination. Hedge funds can use to various financial investments like shorts, options, and by-products. They can likewise make alternate financial investments.

Who provides reliable Real Estate For Accredited Investors options?

You might choose one whose financial investment viewpoint straightens with your own. Do keep in mind that these hedge fund cash supervisors do not come low-cost. Hedge funds typically charge a charge of 1% to 2% of the possessions, in enhancement to 20% of the revenues which offers as a "performance fee".

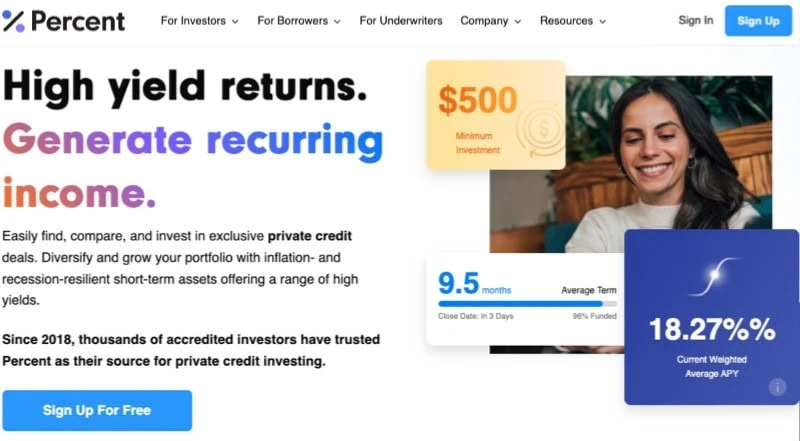

You can buy a property and obtain rewarded for holding onto it. Accredited capitalists have extra chances than retail investors with high-yield investments and beyond.

How long does a typical Exclusive Real Estate Deals For Accredited Investors investment last?

You have to satisfy at the very least one of the complying with criteria to come to be a certified investor: You need to have over $1 million net well worth, omitting your main home. Company entities count as accredited financiers if they have over $5 million in properties under monitoring. You must have an annual income that goes beyond $200,000/ year ($300,000/ yr for partners submitting together) You should be a registered financial investment expert or broker.

Therefore, certified financiers have a lot more experience and money to spread across properties. Accredited capitalists can pursue a wider variety of assets, but more choices do not ensure greater returns. Most financiers underperform the market, consisting of certified financiers. Regardless of the higher condition, recognized financiers can make significant errors and do not have access to expert info.

In addition, financiers can develop equity via positive money flow and residential or commercial property gratitude. Actual estate residential properties need substantial maintenance, and a lot can go incorrect if you do not have the best team.

What is included in Real Estate Syndication For Accredited Investors coverage?

Actual estate syndicates pool cash from recognized capitalists to buy properties aligned with well-known purposes. Certified capitalists pool their money together to fund purchases and property growth.

Genuine estate investment depends on must distribute 90% of their taxed income to shareholders as dividends. REITs enable capitalists to expand quickly throughout lots of building classes with very little resources.

How do I apply for Real Estate Development Opportunities For Accredited Investors?

Financiers will benefit if the stock price climbs because convertible investments offer them much more eye-catching access factors. If the stock topples, financiers can decide versus the conversion and protect their funds.

Latest Posts

Investing In Secured Tax Lien Certificates

Tax Lien Investing 101

Arizona Tax Lien Investing