All Categories

Featured

Table of Contents

For example, if the house owner pays the rate of interest and charges early, this will lessen your return on the financial investment. And if the homeowner proclaims personal bankruptcy, the tax lien certificate will be secondary to the home mortgage and government back tax obligations that schedule, if any. One more threat is that the worth of the property can be much less than the amount of back taxes owed, in which situation the home owner will have little motivation to pay them.

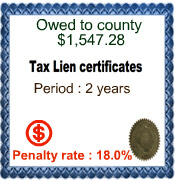

Tax lien certifications are normally sold through public auctions (either online or in individual) conducted every year by county or local tiring authorities. Offered tax obligation liens are commonly published several weeks prior to the public auction, along with minimal proposal amounts. Check the sites of counties where you have an interest in purchasing tax liens or call the area recorder's workplace for a listing of tax lien certificates to be auctioned.

Is Tax Lien Investing A Good Idea

Bear in mind that most tax liens have an expiration date after which time your lienholder rights expire, so you'll need to move quickly to enhance your possibilities of maximizing your investment return. how to invest in property tax liens. Tax obligation lien investing can be a profitable means to buy genuine estate, but success needs comprehensive study and due persistance

Firstrust has more than a decade of experience in supplying funding for tax lien investing, along with a devoted group of qualified tax obligation lien professionals that can assist you leverage potential tax obligation lien investing chances. Please call us to get more information concerning tax lien investing. FEET - 643 - 20230118.

The tax obligation lien sale is the last action in the treasurer's initiatives to collect taxes on real estate. A tax lien is put on every area building owing tax obligations on January 1 yearly and stays until the real estate tax are paid. If the home owner does not pay the real estate tax by late October, the area offers the tax obligation lien at the yearly tax obligation lien sale.

The investor that holds the lien will be notified every August of any type of overdue tax obligations and can back those taxes to their existing lien. The tax lien sale permits tiring authorities to obtain their allocated profits without needing to await overdue tax obligations to be gathered. It likewise supplies a financial investment possibility for the general public, participants of which can purchase tax lien certifications that can possibly make an appealing rates of interest.

When retrieving a tax obligation lien, the homeowner pays the the delinquent taxes along with the overdue passion that has accumulated against the lien considering that it was cost tax obligation sale, this is attributed to the tax obligation lien owner. Please call the Jefferson County Treasurer 303-271-8330 to get benefit info.

Tax Liens Investments

Building ends up being tax-defaulted land if the building tax obligations continue to be unsettled at 12:01 a.m. on July 1st. Property that has actually become tax-defaulted after five years (or 3 years when it comes to residential property that is likewise based on a hassle abatement lien) comes to be subject to the county tax enthusiast's power to offer in order to satisfy the defaulted residential or commercial property tax obligations.

The county tax collection agency might supply the residential or commercial property for sale at public auction, a sealed quote sale, or a worked out sale to a public company or qualified not-for-profit organization. Public public auctions are one of the most typical method of offering tax-defaulted building. The public auction is carried out by the county tax obligation collection agency, and the property is marketed to the highest bidder.

Key Takeaways Browsing the globe of realty financial investment can be intricate, however comprehending different investment opportunities, like, is well worth the work. If you're wanting to expand your portfolio, investing in tax liens could be an option worth discovering. This overview is developed to assist you comprehend the essentials of the tax lien investment strategy, guiding you through its procedure and helping you make educated choices.

A tax lien is a legal claim enforced by a federal government entity on a building when the proprietor fails to pay residential property tax obligations. It's a method for the federal government to guarantee that it accumulates the necessary tax obligation earnings. Tax liens are attached to the building, not the individual, implying the lien remains with the home despite possession adjustments up until the financial obligation is gotten rid of.

Risks Of Investing In Tax Liens

] Tax lien investing is a sort of realty financial investment that includes buying these liens from the federal government. When you purchase a tax lien, you're essentially paying somebody else's tax debt. In return, you gain the right to accumulate the financial debt, plus rate of interest, from the homeowner. If the owner falls short to pay within a given duration, you could also have the chance to seize on the residential property.

The city government then positions a lien on the property and may ultimately auction off these liens to financiers. As a financier, you can buy these liens, paying the owed tax obligations. In return, you receive the right to gather the tax obligation financial obligation plus rate of interest from the homeowner. This rates of interest can differ, yet it is usually greater than standard financial savings accounts or bonds, making tax obligation lien spending possibly lucrative.

It's vital to carefully evaluate these prior to diving in. Tax obligation lien certification spending offers a much lower resources need when contrasted to other forms of investingit's possible to delve into this asset course for as low as a couple hundred dollars. One of the most significant draws of tax lien investing is the possibility for high returns.

In many cases, if the home proprietor fails to pay the tax financial debt, the capitalist may have the possibility to foreclose on the property. This can potentially cause obtaining a property at a portion of its market price. A tax lien often takes concern over other liens or mortgages.

Tax obligation lien spending entails navigating legal treatments, particularly if foreclosure ends up being required. Redemption Durations: Residential or commercial property proprietors usually have a redemption duration during which they can pay off the tax financial obligation and passion.

Affordable Public auctions: Tax obligation lien auctions can be highly affordable, especially for homes in preferable places. This competitors can increase rates and potentially minimize total returns. [Understanding exactly how to buy actual estate doesn't have to be hard! Our on the internet real estate investing class has everything you need to reduce the discovering contour and begin purchasing realty in your location.

Tax Lien Investing Colorado

While these procedures are not made complex, they can be unexpected to brand-new capitalists. If you want getting started, examine the adhering to steps to getting tax liens: Start by informing yourself concerning tax obligation liens and just how realty public auctions function. Recognizing the lawful and financial ins and outs of tax lien investing is vital for success.

Latest Posts

Investing In Secured Tax Lien Certificates

Tax Lien Investing 101

Arizona Tax Lien Investing